Efficient Financial Services Scheduling Software for Advisors

Automate appointments, manage compliance, and integrate with your CRM

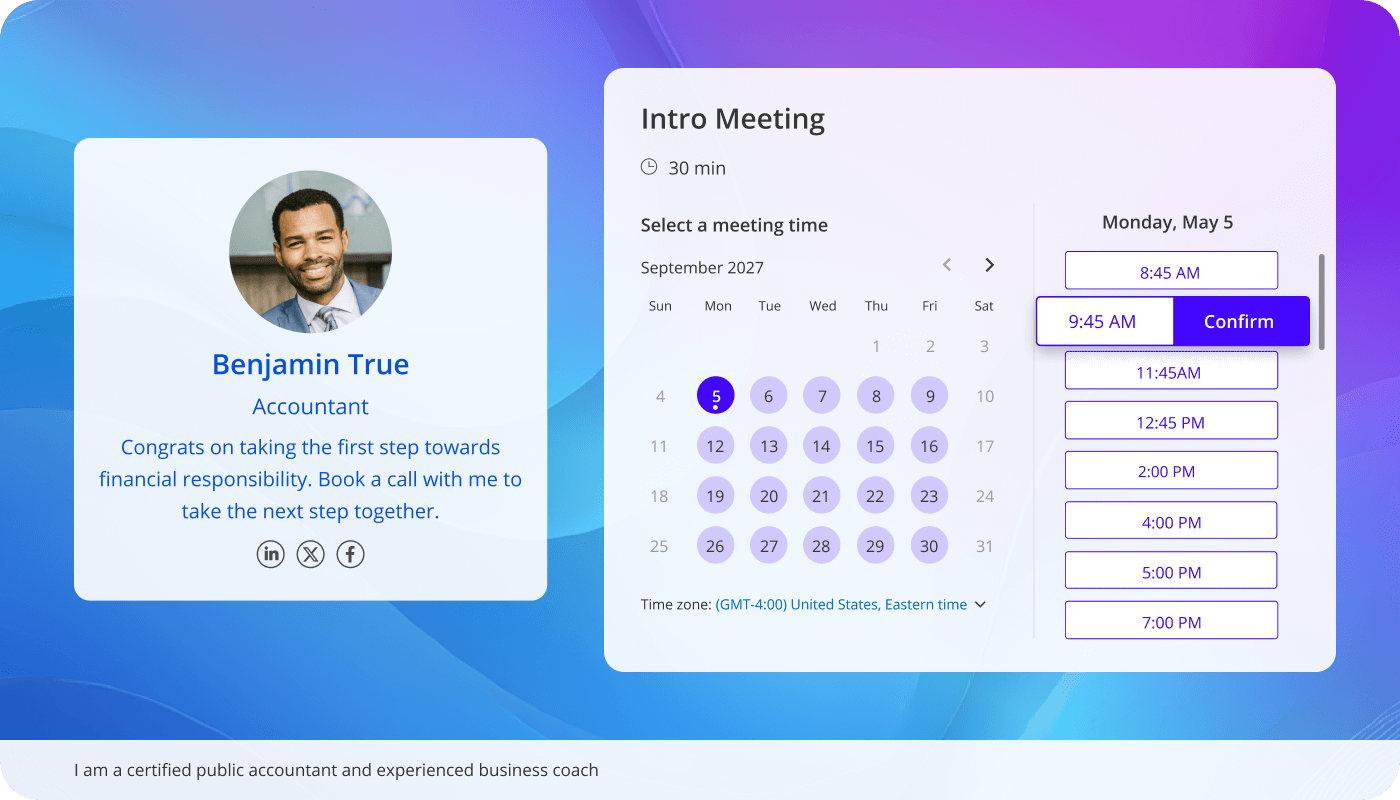

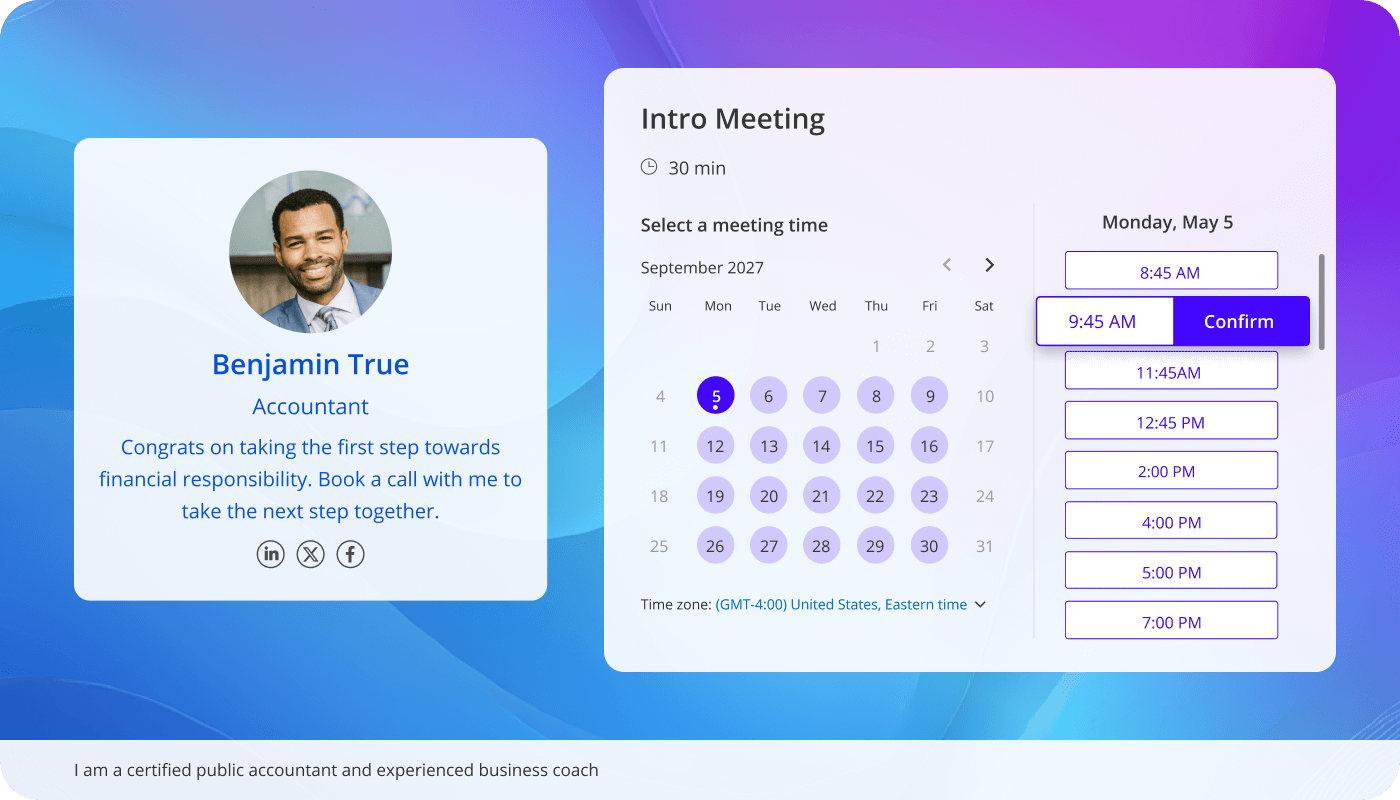

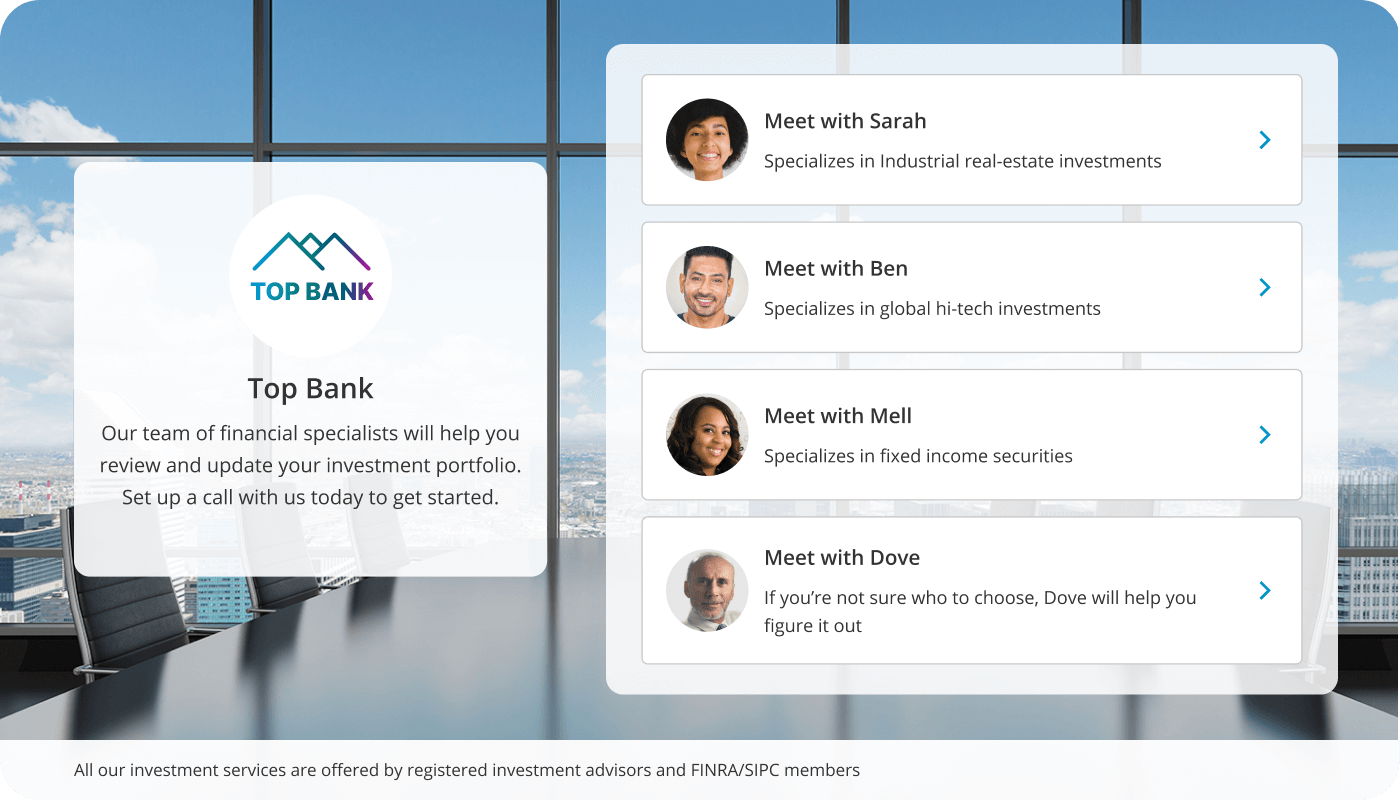

Build Stronger Client Connections with Intuitive Booking Pages

Create booking pages that showcase your expertise, inspire trust, and strengthen loyalty

.png?width=1400&height=801&name=Lawyer%20(1).png)

.png?width=1400&height=800&name=Tax%20Specialist%20(1).png)

.png?width=1400&height=801&name=Lawyer%20(1).png)

.png?width=1400&height=800&name=Tax%20Specialist%20(1).png)

Schedule better, stress less, and focus on driving success

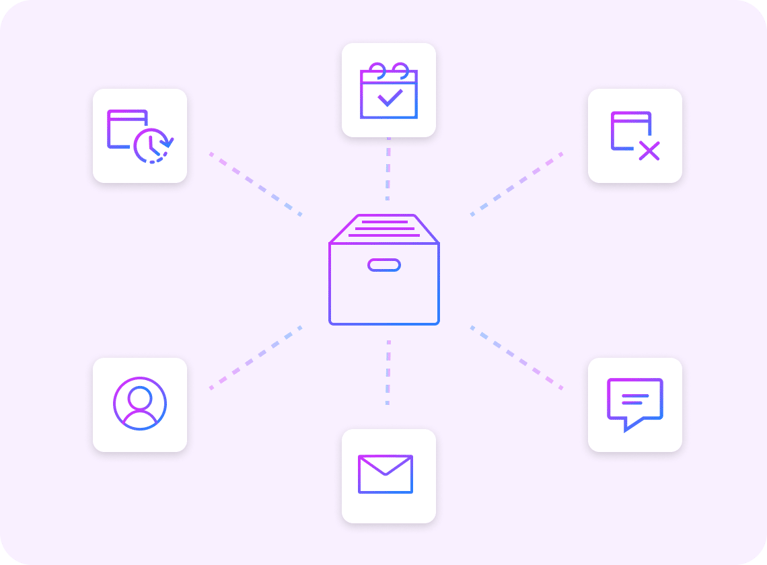

Increase Client Interaction, Reduce Scheduling Overhead

Free up valuable time for client relationships with powerful automation and seamless integrations

.png?width=767&height=565&name=Automate%20Appointment%20Management%20for%20Peak%20Efficiency%20(1).png)

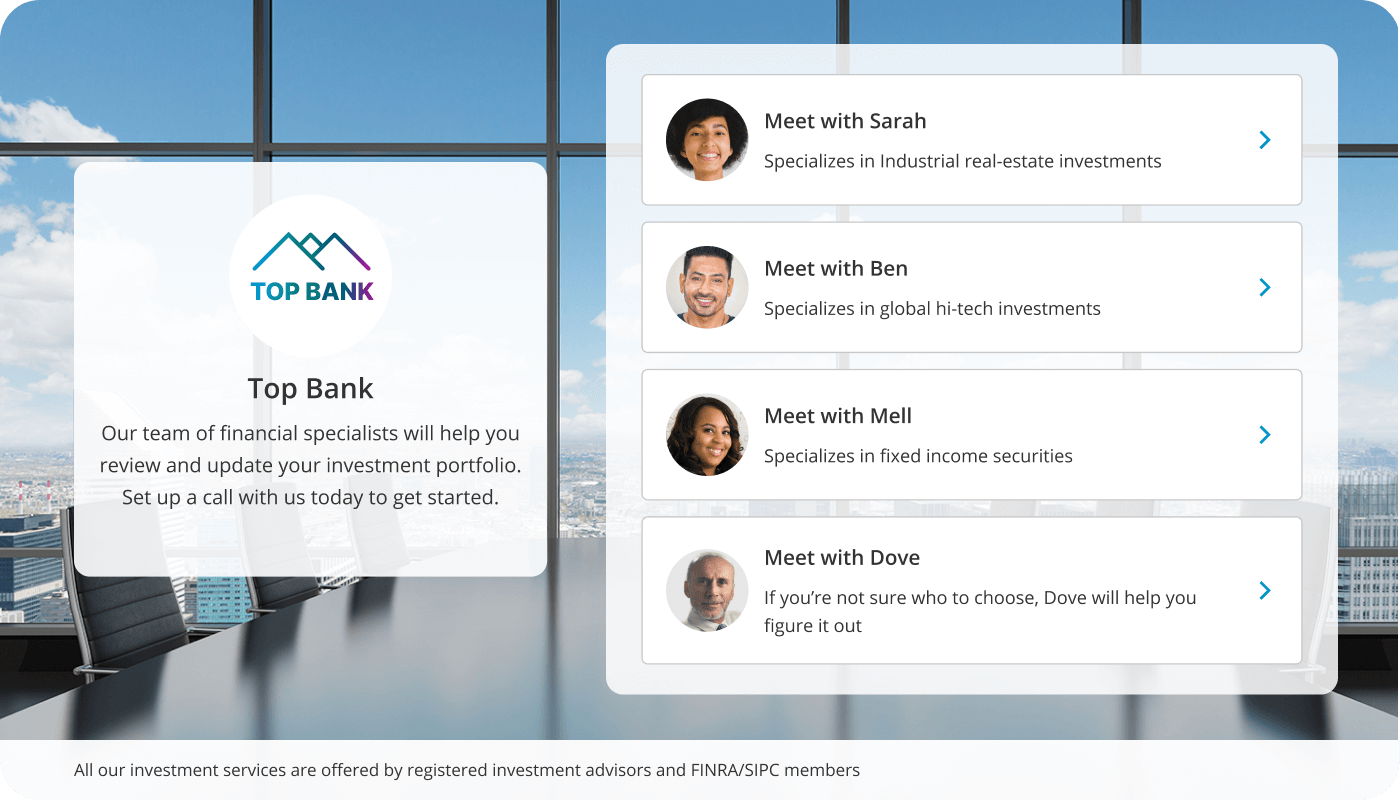

High-Efficiency Appointment Management for Financial Advisors

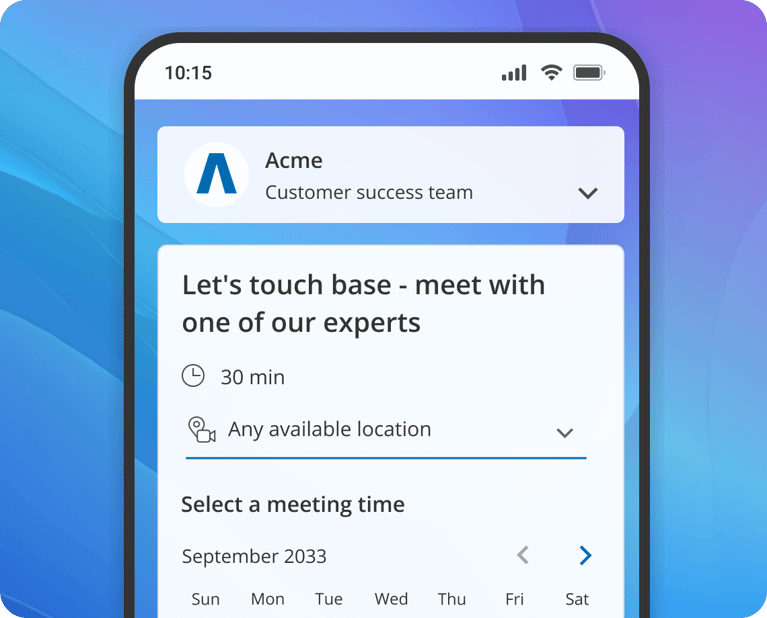

- Offer multiple calendars in one booking hub, giving clients the freedom to choose the advisor or meeting type they want

- Direct prospects to the right booking calendar with interactive routing forms that adapt to their answers

- Deliver top service by using our financial advisor appointment setting software to get to know your client during the booking process

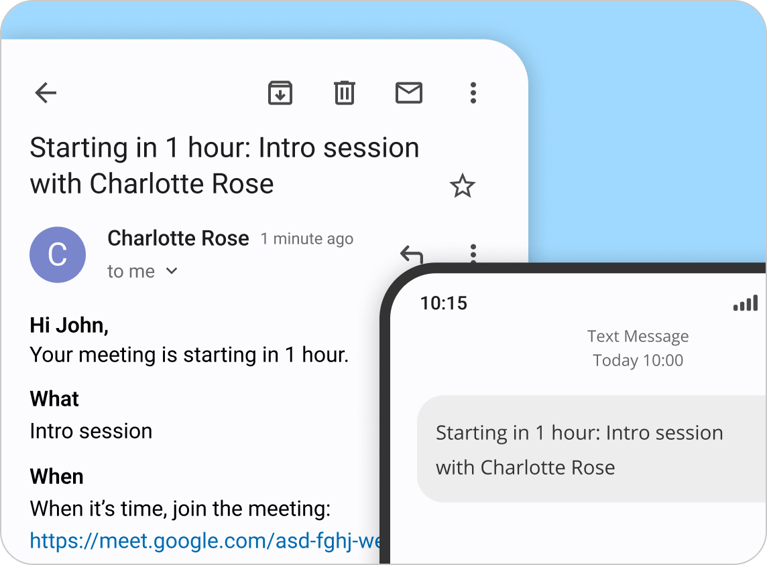

- Significantly reduce no-shows by sending automatic personalized appointment confirmations and reminders and letting clients cancel and reschedule online

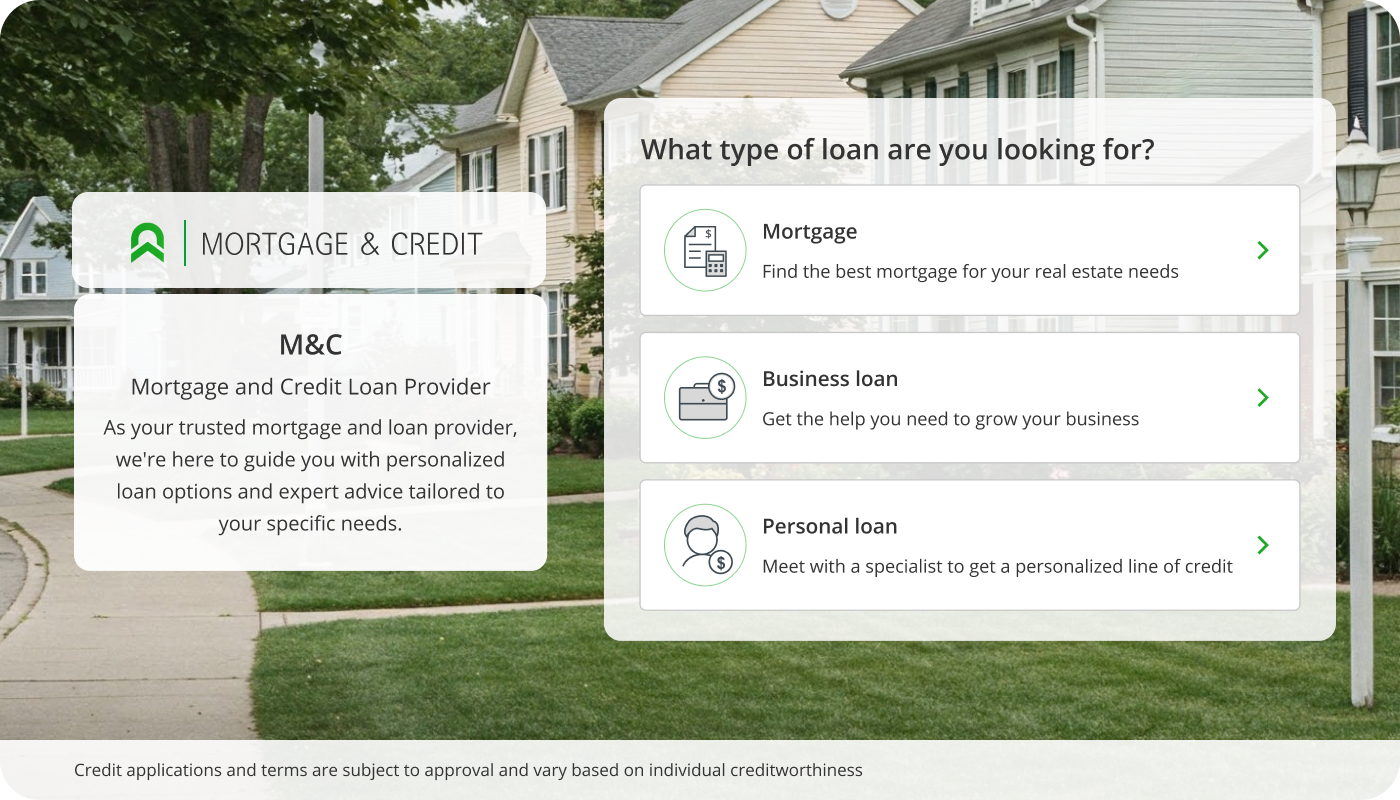

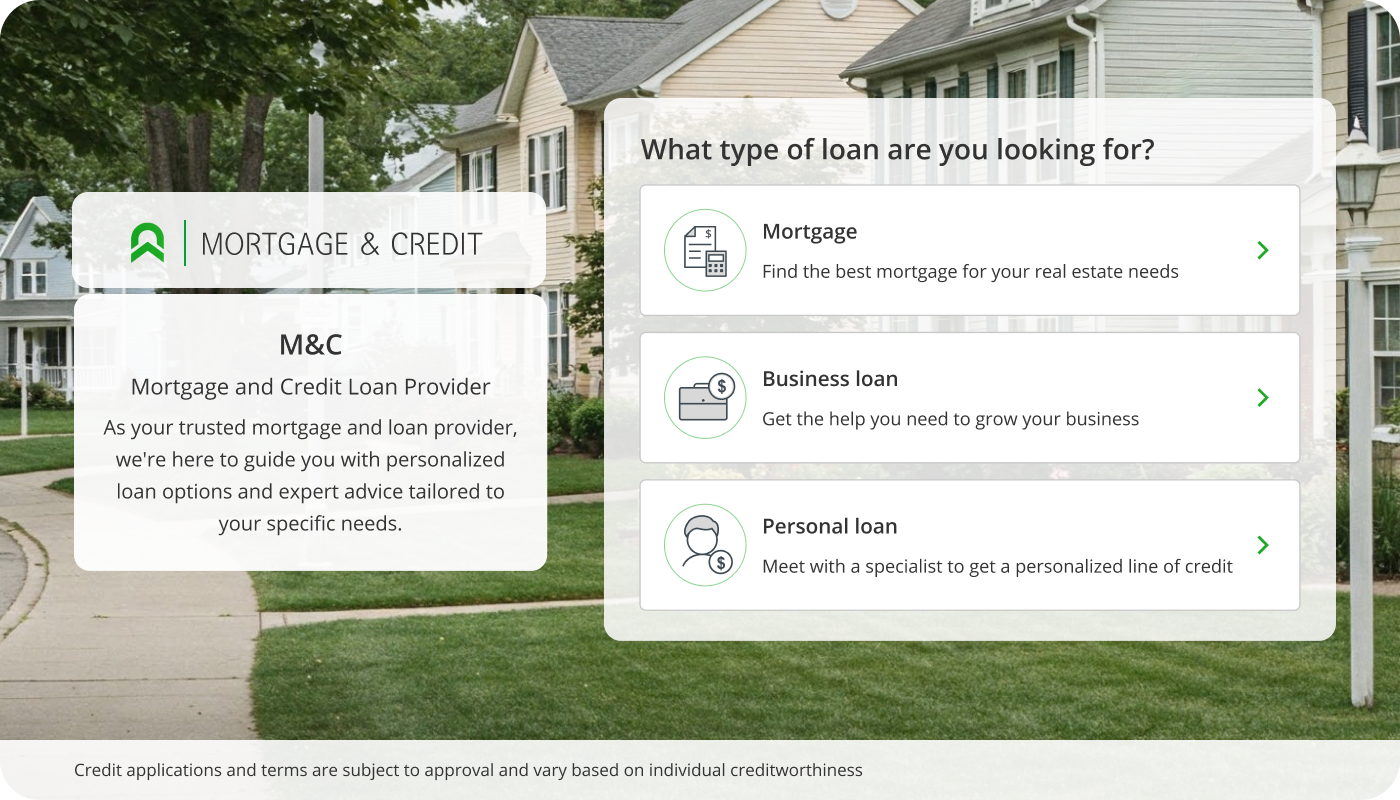

Integrate Key Business Tools with Our Scheduling Software for Financial Services

- Eliminate double bookings and prevent scheduling conflicts by syncing your team’s booking pages with your productivity suite and work calendar

- Streamline your workflow by connecting your booking pages with CRMs like Redtail and Wealthbox for automatic data transfer

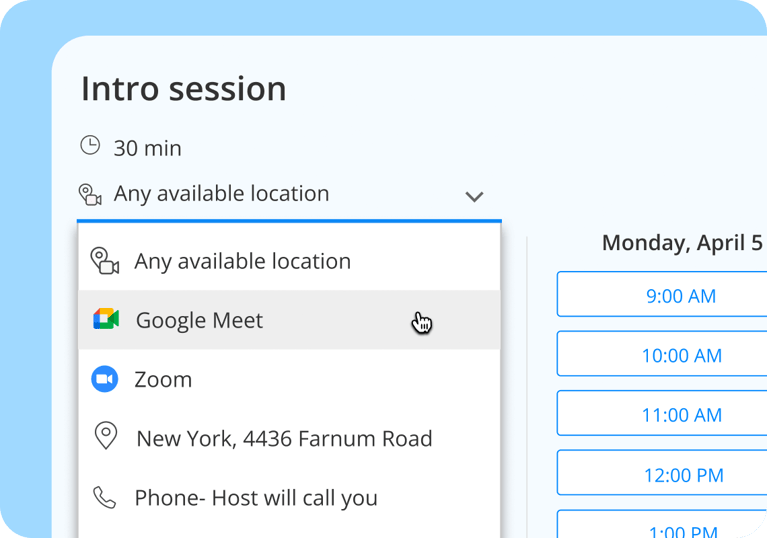

- Integrate your financial services scheduling software with video conferencing platforms like Zoom and Microsoft Teams to facilitate smooth and efficient meetings

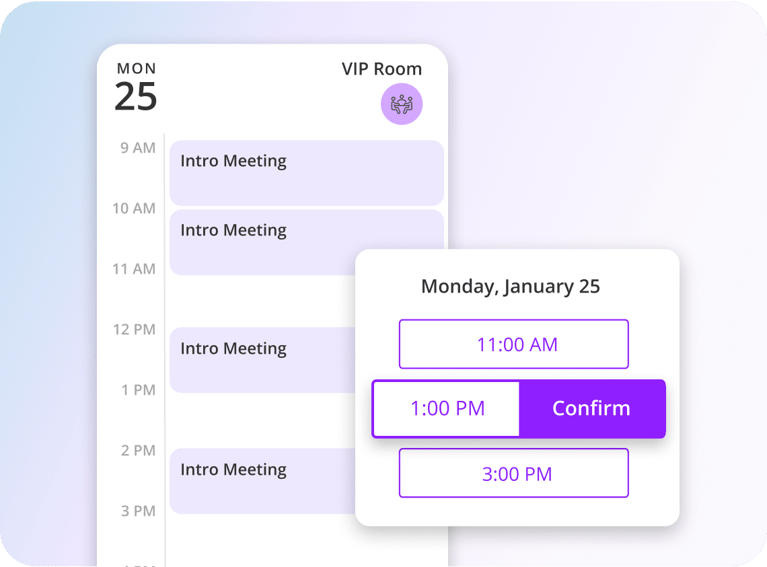

Smart Scheduling and Meeting Orchestration for Financial Advisors

- Manage and reserve meeting rooms automatically, ensuring the right space is always available for client interactions

- Coordinate multi-advisor meetings quickly and easily with dynamic team scheduling features

- Empower clients to select meeting locations and conferencing platforms during booking with our financial advisor booking software

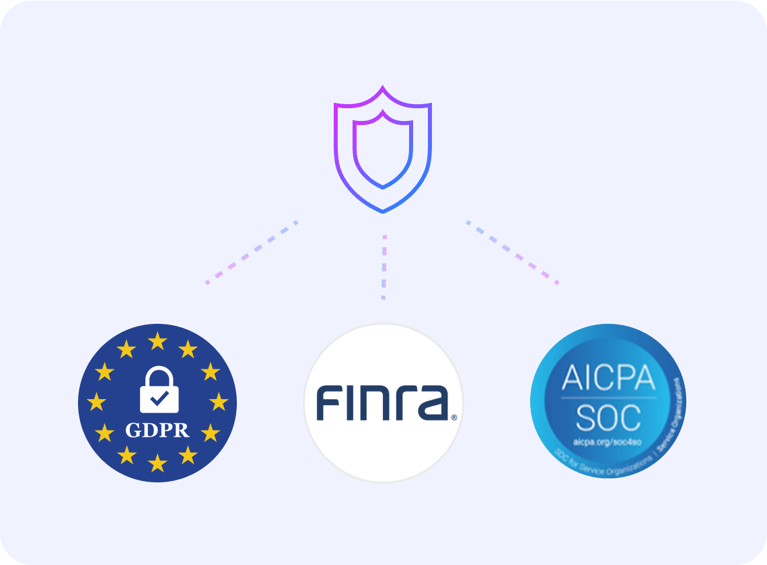

Stay Compliant with Secure Scheduling Software for Financial Services

Deliver a professional, compliant, and secure scheduling experience that protects your account and your clients' sensitive information

Archive Every Scheduling Interaction Automatically

Select one of three automated archiving methods to make sure all your scheduling interactions are secure

- Automatically BCC a designated archive email address on all scheduling communications sent from your OnceHub account

- Send all client communications from a single, monitored corporate email address that is automatically archived for compliance and easy access

- Securely send and automatically archive all scheduling-related emails originating from your advisors' private inboxes — a must-have for financial advisor appointment setting software

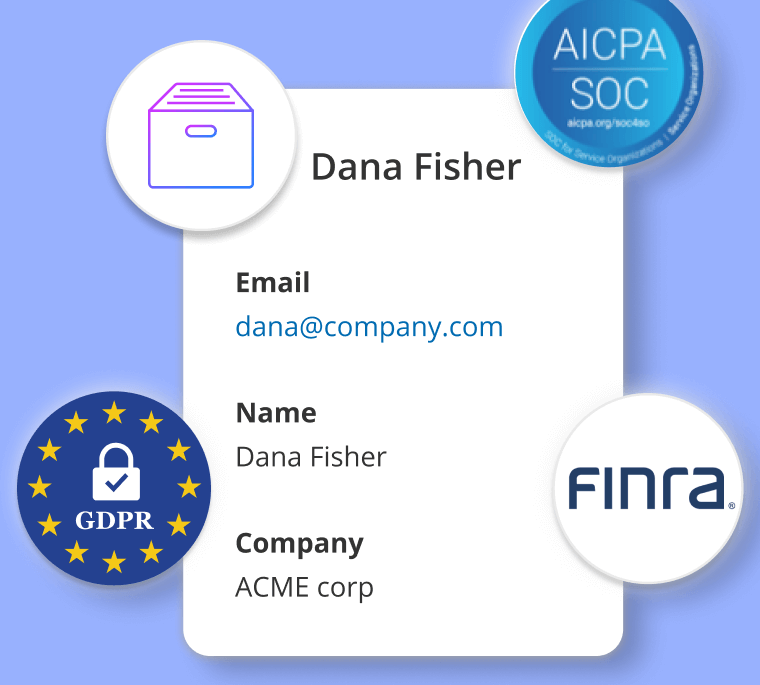

Financial Services Scheduling Software That Complies With Enterprise-Grade Data Security and Privacy Regulations

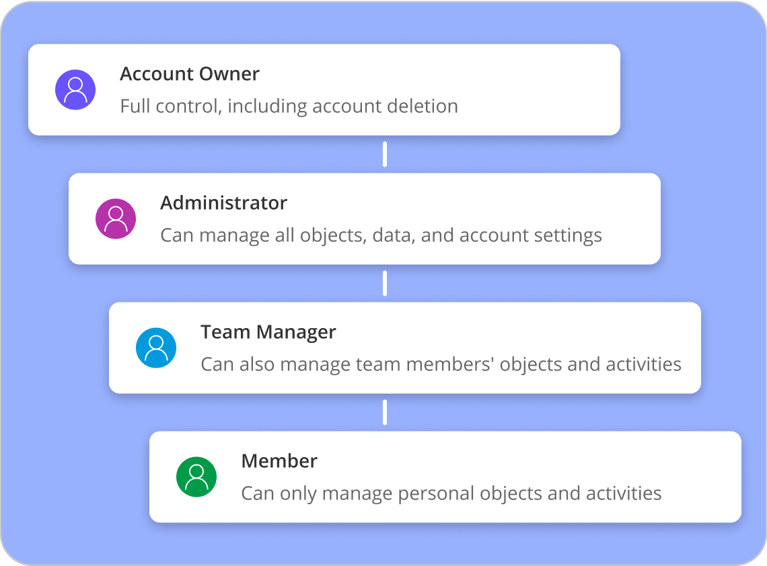

- Define user roles and permissions to control access to sensitive client data

- Add customized disclaimers to the footer of your booking pages

- Adhere to industry standards, including SOC 2, ensuring the protection of clients' financial data

- Protect sensitive information with secure storage solutions and robust data encryption in transit and at rest

- Control access to your account data with two-factor authentication (2FA), single sign-on (SSO) authentication, and custom security policies

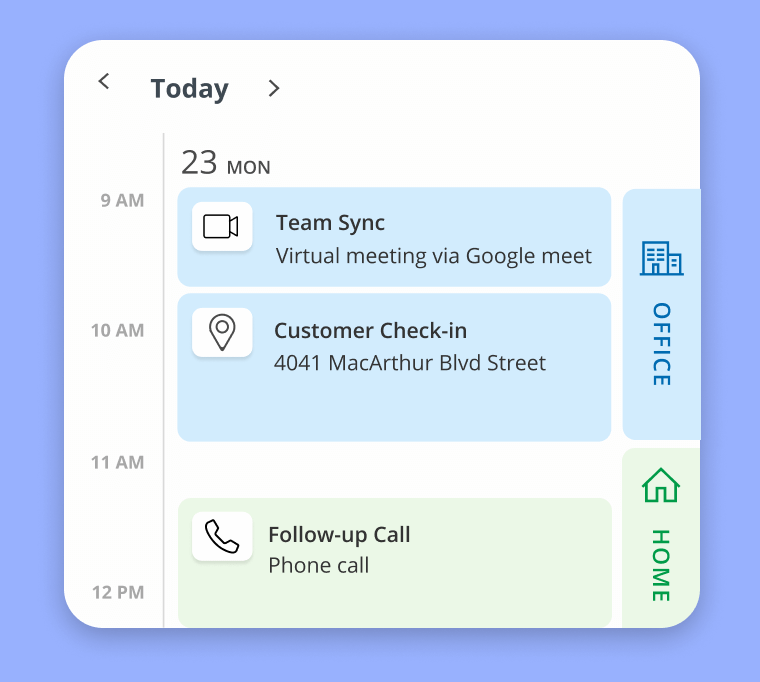

Use location-based scheduling to allow your audience to meet you online or on-location based on their preference and your availability

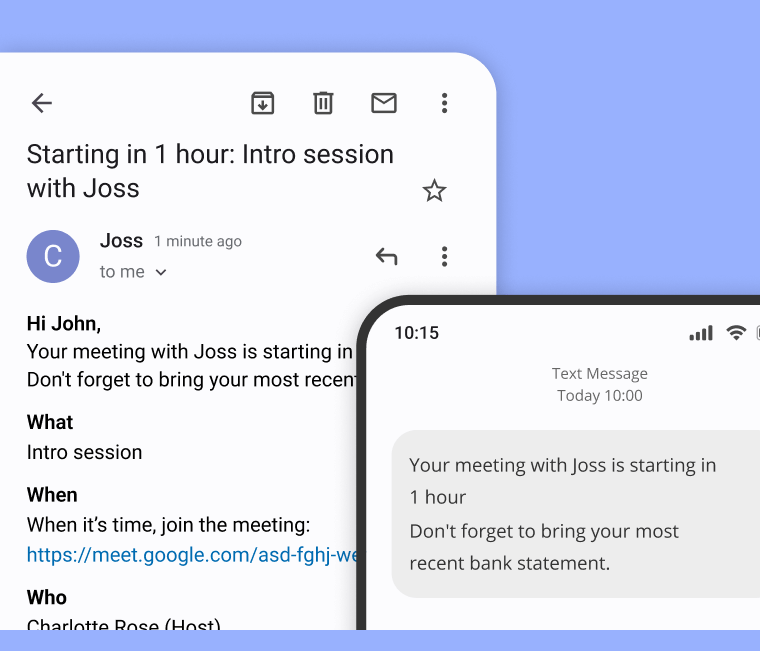

Use customized Email and SMS notifications to remind clients when to show up and what to prepare in advance to make sure every meeting is effective and productive

We comply with strict security regulations like PCI DSS, FINRA & SOC 2, and enable automatic data archiving via BCC, centralized corporate emails, or advisor emails

Schedule better, stress less, and focus on driving success

All the Scheduling Features You Need For More Productive Meetings

Streamline operations, elevate client management, and enhance client relationships

Custom Branded Booking Pages

- Choose financial advisor booking software that elevates your brand and upholds your reputation

- Present a professional online image with booking pages that reflect your firm's logo, colors, and branding

- Customize messaging and content to align with your brand's voice and tone, fostering client trust

- Create a stand-alone booking page with a unique customized link or embed it anywhere on your website

- Offer a seamless booking experience that reinforces your firm's credibility and attention to detail

.png?width=1140&height=840&name=Capture%20Every%20Inquiry%20with%20Intelligent%20Phone%20Booking%20(2).png)

Capture Every Inquiry with Intelligent Phone Booking

- Turn missed calls into scheduling opportunities by forwarding callers to phone booking when you can't answer

- Let phone-first clients call to schedule by providing a direct number for voice activated scheduling

- Lighten the load on your front desk by transferring scheduling requests to phone booking

Automated Appointment Management

- Stop the back-and-forth by using automated financial service scheduling software

- Automatically send personalized appointment confirmations and reminders, minimizing no-shows

- Distribute real-time updates and notifications to both advisors and clients, ensuring everyone stays informed

- Allow clients to easily reschedule or cancel appointments, reducing administrative burden

- Automate post booking reminders and follow ups with thank you messages, and document delivery

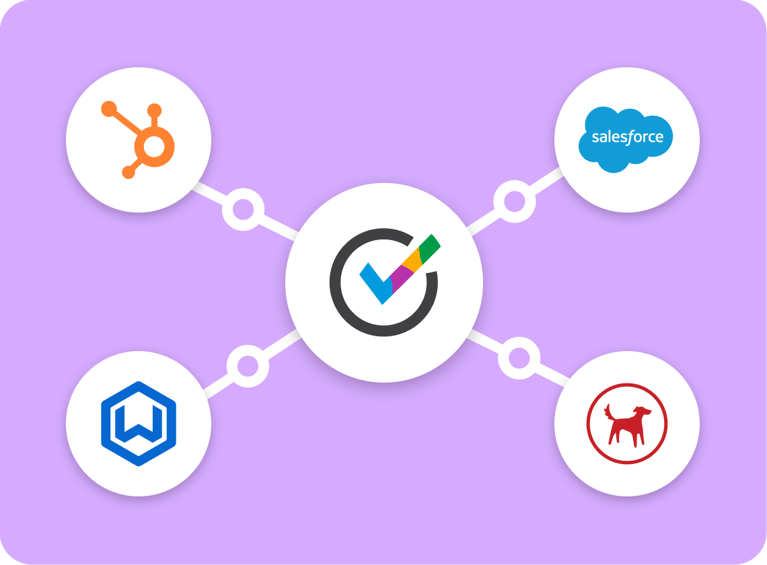

CRM Integrations

- Keep your financial advisor appointment setting software connected using our native integration with Salesforce and HubSpot

- Connect to thousands of apps (including Redtail and Wealthbox) via Zapier

- Automatically send client data to your scheduling platform and CRM, eliminating manual entry

- Trigger automated workflows within your CRM based on appointment bookings and updates

- Maintain a unified client view by consolidating scheduling activity with CRM records

- Track client interactions and appointment history directly within your CRM

User Permissions and Controls

- Define user roles and permissions to restrict access to sensitive client information and ensure compliance with internal security policies

- Maintain detailed audit logs to track user activity and ensure accountability

- Control which team members have access to which booking pages and scheduling features

Efficient Room and Resource Scheduling

- Integrate your booking calendar with your room directory to make sure every meeting has a room and avoid room scheduling blunders

- Manage meeting room availability and resource allocation with an integrated scheduling system

- Allow clients to select preferred meeting locations and room configurations during booking

- Prevent double room bookings and optimize resource utilization

Enhanced Data Security and Compliance

- Adhere to PCI DSS, FINRA, SOC 2, and other financial industry standards with secure scheduling software for financial services

- Utilize data encryption and secure storage to safeguard client information

- Implement features that support regulatory compliance requirements for the financial industry

- Maintain comprehensive audit trails for compliance reporting and accountability

Schedule better, stress less, and focus on driving success

Frequently Asked Questions about Financial Services Scheduling Software

-

How does your system help with compliance?

We offer top compliance on several levels:

Operational processes: As a provider to organizations across the financial services sector we follow all the security and compliance obligations required for your FINRA compliance. We are also a SOC 2 certified vendor.

Product security: We implement strong product mechanisms such as access control and data encryption.

Electronic client communication: You maintain full control over communication content and can easily add necessary disclaimers to your booking pages. Our system is designed to work smoothly with your archiving setup.

-

Can I customize the booking page with my company's branding?

Absolutely. You can customize the booking page with your logo, colors, and branding elements to maintain a consistent professional image.

-

Is it possible to manage multiple advisors and meeting rooms?

Yes, our platform allows you to manage multiple advisors, office locations, and meeting rooms, ensuring efficient scheduling for your entire team.

-

Does your software integrate with Redtail and Wealthbox?

Yes, our software integrates via Zapier with Redtail and Wealthbox, allowing for seamless data transfer and workflow management.

-

What types of payment options are available?

We offer monthly and annual subscription plans. Please see our pricing page for more details.

In terms of payment methods, we accept all major credit and debit cards, including Visa, MasterCard, American Express, Discover and JCB. We also accept payment via PayPal.

-

Can I set up different appointment types with varying durations?

Yes, you can create multiple appointment types with custom durations and availability settings.

-

What happens when I sign up?

After signing up, you gain free access (no credit card needed) to a 14-day trial of our Engage plan. This is a fantastic opportunity for you to experience firsthand the advanced features and capabilities of the OnceHub platform.

-

What makes the best financial advisor appointment setting software?

The best financial advisor appointment setting software combines automation, compliance, and security. It allows advisors to reduce no-shows, save hours each week, and provide clients with a seamless booking experience while meeting FINRA, HIPAA, and SOC 2 requirements.

-

How does scheduling software help financial services compliance?

Reliable scheduling software for financial services automatically archives communications, encrypts sensitive data, and supports regulatory requirements. With OnceHub, every scheduling interaction is secure, monitored, and stored for compliance and accountability.

-

Why should financial advisors use booking software?

Financial advisor booking software saves time, eliminates manual scheduling, and improves the client experience. Clients get the flexibility to book online at their convenience, while advisors stay focused on advising rather than admin tasks.

-

Can scheduling software integrate with financial CRMs?

Yes. OnceHub integrates natively with leading CRMs like Salesforce, HubSpot. Via Zapier you can also connect with Redtail, Wealthbox, and more. This ensures your financial services scheduling software works seamlessly with your existing client records and workflows.

-

How does financial services scheduling software improve client relationships?

By reducing scheduling friction, sending automated reminders, and personalizing confirmations, financial advisor appointment setting software makes it easier for clients to connect with you. The result is more consistent interactions and stronger client trust.