Appointment Setting for Financial Advisors: Challenges, Compliance, Meeting Prep and Best Practices

For financial advisors, scheduling a meeting is more than finding a calendar slot. It’s an opportunity to demonstrate trust, empathy, and accessibility with your clients and prospects. After all, you're not just managing their money, you're managing their dreams, retirement, and family futures. That’s why even small details like how easily clients can book a meeting with you matter a lot.

In financial services, scheduling isn't just a chore; it's a mission-critical function that impacts every part of your practice. It influences your ability to win new business, keep existing clients engaged, and run an efficient operation.

Think of your calendar in two parts:

- Sales: This is about meeting new prospects. If the booking process is slow or clunky, a potential client's excitement can fade, and they might turn to a competitor. A quick, frictionless booking experience can be the difference between a new client and a lost opportunity.

- Service: This is about nurturing your client relationships. If clients find it difficult to meet with you or their appointments get lost in a mess of email threads, trust can erode. A smooth and professional scheduling process only will reinforce your competence and commitment.

The right scheduling tool can eliminate friction, ensure compliance, and set the stage for strong, lasting, and harmonious client relationships. It’s a humongous investment in your business's most valuable asset: your time. Professionals who utilize appointment setting services often see increased productivity and more effective time management, making it a strategic choice for financial advisors.

What are the Scheduling Challenges for Financial Advisors?

Financial advisors face a unique set of challenges that a standard calendar app can’t solve. Let’s break down the two primary use cases.

Smarter Prospect Scheduling

Financial advisors face three big challenges when it comes to scheduling new prospects:

Delayed responses risk lost opportunities

If a high-net-worth prospect fills out your form at 9 p.m. and doesn’t hear back until the next day, chances are they’re already speaking with another advisor. There is a study by James Oldroyd, PhD Professor, MIT that the average response time to an online lead is 48 hours, while responding within five minutes can increase your odds of connecting by 100x. Financial advisors should follow up with leads who have shown interest to ensure opportunities are not lost.

Solution: A publicly available booking link - on your website, in your email signature, and in marketing materials. Lets prospects instantly book time while their interest is at its peak.

Not every lead is worth your time

You don’t want to spend an hour with someone who isn’t a good fit or isn’t serious about financial advice.

Solution: Use simple but powerful qualifying questions upfront, such as:

- What prompted you to seek financial advice at this time?

- What is your primary financial goal for this meeting?

- Do you currently work with another financial advisor?

These filters protect your calendar so you spend time only on the right conversations. Additionally, confirming appointments can reduce no-shows and reinforce your presence, ensuring a more productive use of time.

- What prompted you to seek financial advice at this time?

- What is your primary financial goal for this meeting?

- Do you currently work with another financial advisor?

These filters protect your calendar so you spend time only on the right conversations.

Meetings can fail if clients come unprepared

A prospect may show up without the right documents or clarity about their goals. That wastes everyone’s time and hurts your first impression.

Solution: Automated reminders with preparation prompts ensure prospects bring what they need and arrive ready for a productive discussion.

Together, these steps help you capture interest quickly, qualify effectively, and ensure every meeting is the right meeting.

Strengthening Relationships With Existing Clients

.png?width=1400&height=800&name=Tax%20Specialist%20(1).png)

For existing clients, the needs go well beyond financial planning. They want to feel cared for, supported, and in control of their relationship with their advisor. Meeting these expectations requires both consistency and flexibility. Events, both virtual and in-person, are effective tools for generating leads and building trust, which can further strengthen these relationships.

Build Trust With Proactive Guidance

Clients want reassurance that their advisor is actively guiding them, and not just reacting when they call. They value structure that shows you’re looking out for their long-term success.

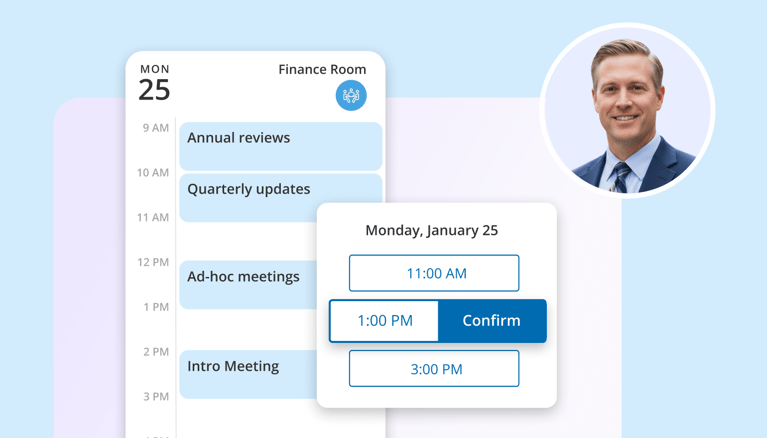

Solution: Establish a strategic meeting cadence that balances attentiveness with respect for their time:

- Annual reviews to evaluate long-term goals.

- Quarterly updates to review performance and market shifts.

- Ad-hoc meetings for sudden life events or market volatility.

Be Accessible When It Matters Most

Even with regular touchpoints, unexpected challenges arise. During these moments, clients need to feel you’re within reach.

Solution: A booking calendar empowers clients to schedule time instantly when urgent needs arise, reinforcing your role as a reliable and responsive partner.

Give Clients Control Over Their Experience

Not every client wants the same type of meeting. Some may prefer a quick check-in with an associate, others a deep-dive session with you.

Solution: A booking hub puts clients in the driver’s seat, letting them choose the type of meeting and the person they meet with. They can even invite key decision-makers, like a spouse, parent, or business partner, directly from the booking page, ensuring everyone who matters is in the room.

A J.D. Power study found that 75% of Gen Y and Gen Z clients prefer digital-first interactions, while older clients often value a phone call. Offering multiple scheduling options ensures every client feels supported in the way they prefer to communicate.

Why is Compliance and Security a Non-Negotiable for Appointment Setting Services?

For financial advisors, compliance isn’t just red tape, it’s the foundation of client trust. But here’s the challenge: different types of advisors follow different rules, and that changes how you should use scheduling tools. Avoiding technical jargon when communicating with prospects is also crucial to keeping them engaged and ensuring clarity in your interactions.

1. RIAs (Registered Investment Advisors) - SEC Oversight

For RIAs, compliance is about a fiduciary duty, which means you are legally obligated to act in your client's best interest at all times. This applies not only to investment advice but also to how you conduct your business, including communications.

- Expanded Risk: The SEC’s Rule 206(4)-7 requires RIAs to maintain written policies to prevent violations. Every client communication—even a scheduling email—is considered a business record. Failing to log these communications can raise red flags during an SEC exam.

- What to Look For: A scheduling tool must provide a full audit trail of all activity, along with automatic archiving (e.g., BCC to a compliance archive). It should also align with broader data security standards like SOC 2 and GDPR, reinforcing your ability to demonstrate strong compliance controls.

2. Broker-Dealers - FINRA Oversight

Broker-dealers are primarily governed by FINRA, which focuses on suitability and record-keeping standards. This means any product or service recommendation must be suitable for the client's financial situation, and all related communications must be logged.

- Expanded Risk: Under FINRA Rule 2210, even a booking link can be considered a retail communication. If it lacks proper disclosures—like your firm’s name or disclaimers—it could trigger violations and penalties.

- What to Look For: Your scheduling tool must allow booking pages to include mandatory disclosures and disclaimers, while also integrating with compliance-approved CRMs (e.g., Redtail, Wealthbox). Platforms that also meet FINRA, SOC 2, and PCI DSS standards further strengthen your compliance posture.

3. Insurance Advisors - State Regulators

Insurance advisors must comply with state-level suitability and disclosure requirements, which can vary significantly. Their focus is on ensuring that a product recommendation, such as an annuity, is suitable for the consumer's needs and financial situation.

- Expanded Risk: If a prospect books a meeting without clearly understanding its purpose, you could be at risk. Transitioning into a product discussion without proper context may violate disclosure rules.

- What to Look For: Scheduling tools should support custom meeting types (e.g., Insurance Discovery Call or Annuity Review) with tailored descriptions. They should also allow disclaimers directly on booking pages. Tools that also comply with GDPR ensure client data is handled responsibly across jurisdictions.

4. Hybrid Advisors - Dual Registration (SEC & FINRA)

Hybrid advisors face the most complex compliance environment, as they must adhere to both the SEC's fiduciary standard for their RIA business and FINRA's suitability rules for their broker-dealer activities.

- Expanded Risk: A financial planning consultation may fall under SEC oversight, while a follow-up email about a mutual fund could fall under FINRA. A single, rigid scheduling process can therefore create compliance blind spots.

- What to Look For: Flexibility is key. Your scheduling tool must support multiple meeting types with tailored disclaimers—differentiating between, for example, a Financial Planning Consultation (RIA) and a Product Suitability Review (Broker-Dealer). Platforms that are SOC 2 certified and follow Cloud Security Alliance best practices provide added assurance for dual registrants.

Compliance in scheduling is not one-size-fits-all. A robust scheduling platform like OnceHub is a critical tool for navigating these complexities. It offers features specifically designed for regulated industries:

- Audit Trails: Maintain detailed logs of all scheduling communications for reporting.

- Secure Archiving: Automatically log emails to compliance systems via BCC or centralized archives.

- Customization: Tailor booking pages with required disclosures, disclaimers, and meeting types before a meeting is booked.

- Advanced Routing Forms: Collect required information and disclosures before a meeting is booked, ensuring regulatory suitability checks are met and prospects are routed to the right advisor.

- Industry Alignment: OnceHub adheres to leading standards including FINRA, SOC 2, GDPR, PCI DSS, Cloud Security Alliance, and rigorous due diligence protocols.

These features help you not only stay compliant but also build a more professional and trustworthy practice.

How to Prevent No-Shows and Get to Schedule More Appointments?

.jpg?width=767&height=438&name=How%20to%20Stop%20No-Show%20Appointments%20and%20Win%20Back%20Your%20Time%20(1).jpg)

A missed meeting is a drain on your most valuable resource: your time. For a financial advisor, it can also mean a missed chance to strengthen a client relationship or close a new prospect. Worse, repeated no-shows can erode the trust that is central to financial planning. The good news? With the right scheduling strategies, many no-shows can be prevented.

Here are some proven strategies financial advisors can use to minimize no-shows:

- Qualifying Questions: When a client or prospect takes the time to answer a few prep questions, such as “What’s your top financial goal for this meeting?” - they feel more invested and are less likely to skip the appointment.

- Smart Booking Windows: Setting rules around availability, such as requiring bookings at least 48 hours in advance, helps reduce last-minute cancellations. This is especially helpful for wealth managers or retirement planners whose calendars fill quickly.

- Automated Reminders: Automated email and SMS reminders are one of the most effective tools. Studies show they can cut no-show rates by up to 50%. For advisors, this means more consistent client reviews, portfolio check-ins, and planning sessions.

Some firms even experiment with strategic overbooking, for example, booking two short 15-minute consultations during the same slot. If one prospect doesn’t show up, the advisor still makes productive use of their time.

The Art of Scheduling Meetings as a Financial Advisor for Firm

Top advisors don't just take meetings; they orchestrate them. They design a meeting cadence that ensures every client receives the right level of attention at the right time.

The right scheduling tool helps you execute this plan seamlessly:

Meeting Templates

Create templates for different meeting types just like you wear different clothes for different occasions and seasons (e.g., "Annual Review," "Quarterly Check-in," "Portfolio Assessment"). Each template can have a unique duration, location, and set of prep questions.

Leverage Automated Workflows

Automate the entire booking life cycle from initial contact to follow-up. This frees up time from administrative tasks, allowing you to focus on high-value client interactions and increase overall meeting volume without adding to your workload.

Implement Smart Prospect Qualification

Use routing forms to ask key questions before a meeting is booked. This ensures your calendar is filled with serious prospects, increasing your conversion rate from a scheduled meeting to a new, paying client.

Use Analytics to Optimize Your Strategy

Track key metrics like popular meeting types, booking times, and no-show rates. Use this data to adjust your availability and refine your scheduling to attract more high-quality meetings.

Location Options

Offer flexibility with clear location choices. In-person meetings are great for building deep trust, while virtual meetings save time and fit into busy lifestyles. With OnceHub, you can set different availability rules per location, such as Tuesdays at Office A, Fridays virtual - so clients pick what works best for them. This reinforces adaptability and professionalism. Even Sherlock meets a few of his clients outside 221 B Baker Street..!

What are the Features to Look for in a Scheduling Tool?

A basic calendar app won't cut it. Your scheduling software should be a robust platform designed for the complexities of a financial practice.

Look for these essential features:

#1 Calendar and CRM Integrations:

The tool must sync instantly with your calendar (Google, Outlook, etc.) to prevent double-bookings and integrate with your CRM (e.g., Wealthbox or Redtail) to log activities automatically. Look for platforms that also integrate with video tools (Zoom, Teams) to auto-generate links, compliance archives (via BCC), and workflow tools (like DocuSign or Zapier) so meetings trigger next steps seamlessly. These integrations reduce admin and keep your practice running smoothly.

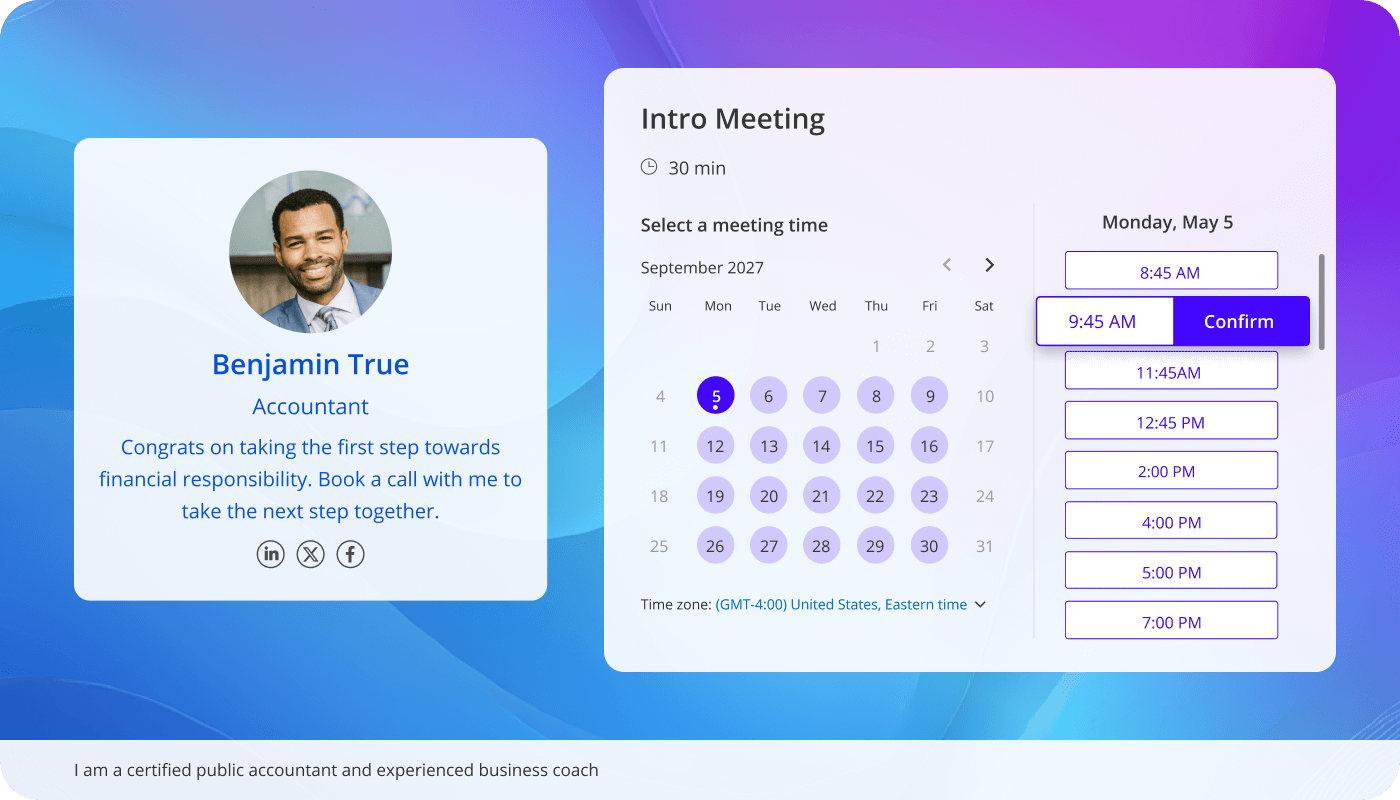

#2 Advanced Routing Forms:

Beyond simple questions, look for forms that can intelligently route a prospect to a specific advisor or service based on their answers.

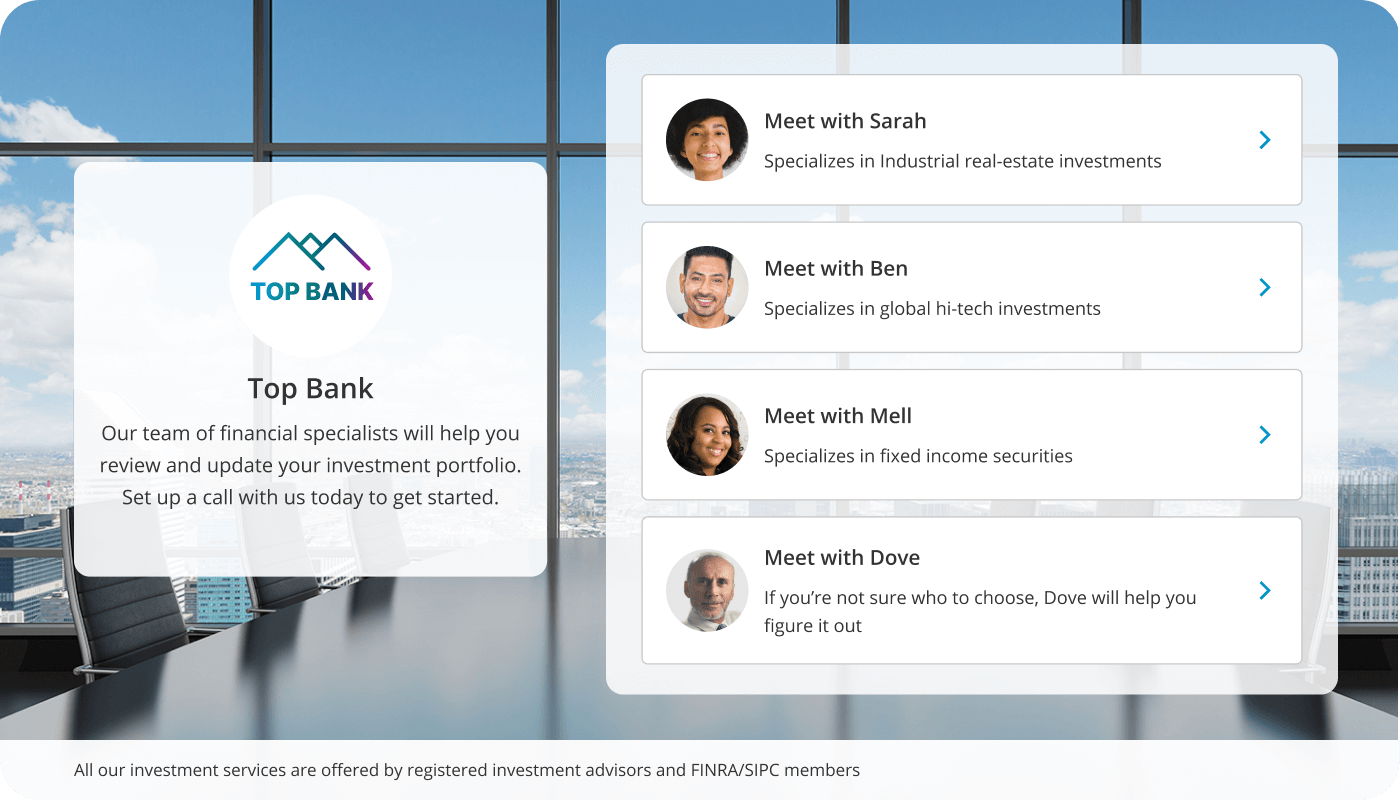

#3 Booking Hubs:

For firms with multiple advisors, a central hub allows clients to see and book with the right person, streamlining lead distribution.

#4 Multi-Host and Panel Scheduling:

For meetings with a spouse or a team of advisors, the tool should allow for multi-host and panel scheduling. This simplifies the process of getting multiple people on a single calendar invite, ensuring all key parties are included in crucial financial conversations.

#5 Built-in Security and Compliance:

The software should go beyond basic security. Look for built-in features like audit trails for communication, the ability to add legal disclaimers to booking pages, and compliance with industry standards like SOC 2 to protect sensitive client data.

#6 Custom Meeting Durations and Buffers:

Every meeting is unique. The tool must allow for custom durations for different appointment types (e.g., 15 vs. 60 minutes) and let you set buffer time between meetings, ensuring you have time for preparation and notes.

Make Every Interaction Count

Create meaningful scheduling experiences

How Financial Advisors Should Use OnceHub to Enhance their Appointment Setting Process?

Segment Booking Pages

- Create separate booking pages or “event types” for new prospects (intro calls) vs. existing clients (check-ins, portfolio reviews).

- Use different availability rules, durations, communication style for each segment, e.g. more flexible slots for VIP/current clients, stricter for prospects.

- This allows more tailored experience, better resource allocation, and clarity in scheduling.

Use Routing Forms / Qualification Up-Front

- Collect essential info before booking: e.g. “What asset size are you managing?”, “What are your goals?”, “Preferred meeting type (virtual / in-person)”.

- Based on answers, route the booking to the right advisor, service type, meeting length etc.

- Helps filter out low-fit leads, reduces wasted meetings, ensures that when a meeting is scheduled, both parties are prepared.

Leverage Resource Pools & Team Scheduling

- For practices with multiple advisors, specialists, or locations: use resource pools to distribute new prospect meetings or existing client check-ins evenly (or by priority / expertise).

- Also useful for covering absences, vacations, or busy periods.

Offer Multiple Meeting Types & Locations

- Provide options: virtual, face-to-face, phone; multiple offices if available.

- Also allow addition of guests (e.g. spouse) or combining multiple advisors (panels) when needed.

- Set up meeting templates for different types (e.g. “Annual Review”, “Risk Assessment”, “Quick Check-In”).

Embed Booking & Publicize Links Widely

- Put booking links on website, client portal, email signature, newsletters, etc. So clients/prospects can find them easily.

- Use master pages or booking hubs for multiple pages/locations to make sharing simpler.

Use Automated Reminders, Confirmations, Reschedules

- OnceHub can send automatic email/SMS reminders and allow rescheduling/cancellation online. This helps reduce no-shows.

- Also include prep instructions via these reminders (bring documents, fill forms, etc.) so meetings are more productive.

Ensure Compliance & Security are Built-In Features

- Use features like BCC of scheduling-related emails to archives, audit trails, two-factor authentication, secure storage.

- Add disclaimers where needed on booking pages. Make sure all scheduling communications are logged.

Track Analytics & Use Insights to Improve

- Monitor booking trends: peak times, most requested meeting types, no-show rates, conversion from “prospect booking” to client.

- Use those metrics to adjust availability, refine event types, or tweak the qualification / routing form.

Strategic Meeting Cadence & Blocking Time

- Pre-block recurring blocks in calendar for key service meetings (e.g. quarterly reviews, annual check-ins), research, client prep.

- Use OnceHub to set fixed windows for certain services to ensure balance between prospecting and servicing.

Integrations to Automate Workflows

- Integrate OnceHub with your CRM (Wealthbox, Redtail, HubSpot, etc.) to sync prospect/client data.

- Use automation (Zapier or native connectors) to trigger follow-ups, reminders, and tasks when meetings are booked or certain form responses are given.

10 Best Practices for Scheduling Appointments as a Financial Advisor

#1 Publish your booking links everywhere

Add them to your email signature, website, client portal, and newsletters so clients can easily find a time. This increases visibility across multiple channels, including social media and search engines, helping potential customers discover and book with you quickly.

Example: A prospect reads your newsletter at 10 p.m. and books a meeting on the spot instead of waiting until office hours.

#2 Use private links for control

Share private booking links with specific clients or campaigns, often paired with routing forms, to protect your calendar and ensure only pre qualified prospects can schedule. This targeted approach helps you focus on your ideal target market and manage your sales pipeline effectively.

Example: You send a private link to a high-net-worth client that shows more flexible time slots than your public page.

#3 Offer both virtual and in-person options

Give clients the flexibility to choose how they want to meet, whether online, by phone, or face-to-face. Offering this choice demonstrates your understanding of different client preferences and helps build trust as a thought leader who adapts to client needs.

Example: A Gen Z client may prefer a quick Zoom call, while an older client feels more comfortable meeting in your office.

#4 Monitor your data regularly

Track no-shows, peak booking times, and meeting types so you can adjust your availability and outreach strategy. Use analytics to identify patterns and optimize your sales funnel for better conversion rates.

Example: If you notice most meetings are booked for early afternoons, you can block that window for client calls.

#5 Segment by client type

Create separate booking pages for new prospects and existing clients, with tailored availability and meeting formats. This allows you to personalize messages and education to each group, enhancing engagement and demonstrating full transparency in your appointment setting process.

Example: Your “Prospect Call” link only offers 20-minute intro sessions, while “Client Review” offers 60-minute slots.

#6 Automate reminders and confirmations

Use email and SMS reminders to reduce no-shows and include preparation steps. For example, remind clients to bring documents or upload them securely ahead of time. This ensures every meeting is focused on advice, not paperwork, and helps overcome initial objections about meeting preparation.

Example: Clients get a text reminder with instructions to bring tax documents before their annual review.

#7 Qualify leads before booking

Add short questions to your booking forms to filter out unfit leads and ensure valuable time is spent wisely. Using tools like LinkedIn Sales Navigator can help identify potential customers and tailor your outreach accordingly.

Example: You ask, “What’s your investable asset size?” and route only qualified leads to your calendar.

#8 Leverage team scheduling

If you work in a larger practice, use resource pools or round-robin scheduling to distribute meetings efficiently. Assign an account manager to oversee the scheduling process and ensure consistency in client experience.

Example: A new inquiry is automatically routed to whichever advisor on your team has the lightest schedule that week.

#9 Plan a meeting cadence

Pre-schedule annual reviews, quarterly updates, and ad-hoc availability blocks to stay proactive with your clients. This strategic approach builds genuine interest and nurtures relationships, moving prospects smoothly through your sales funnel.

Example: You block the first week of each quarter for portfolio reviews so they never get pushed aside.

#10 Stay compliant and secure

Choose tools with audit trails, disclaimers, and data privacy safeguards to meet regulatory requirements. Maintain full transparency in your communications and use case studies to demonstrate your proven process and expertise.

Example: All scheduling emails are automatically BCC’d to your compliance archive, keeping records audit-ready.

Wrap Up

In financial advising, meetings are where trust is built, advice is given, and relationships are cemented. A clear scheduling strategy, one that balances sales and service while prioritizing compliance is no longer a luxury but an essential part of a modern and efficient practice.

A platform like OnceHub helps financial advisors deliver a great scheduling experience that is professional, trust-first, and compliance-ready. It enables you to:

- Win more prospects by being instantly available.

- Build deeper client relationships with a seamless booking experience.

- Keep your practice running smoothly with automated, intelligent workflows.

Try OnceHub today for compliance-ready and client-first scheduling!

FAQs

How do I balance the personal touch of a financial advisor with the automation of an online scheduling tool?

Use a scheduling link for convenience but maintain a personal touch through your communications and by offering phone-based scheduling for clients who prefer it. The link saves time, which you can reinvest in high-value, personal interactions during the actual meeting.

Is it arrogant or lazy to send a client a OnceHub or Calendly link?

No, it's a modern and professional way to respect both your time and your client’s. It removes the friction of back-and-forth emails, showing you value efficiency. Most clients appreciate the convenience and control it gives them.

What is the ideal meeting cadence for different types of clients (e.g., high-net-worth vs. young accumulators)?

The ideal cadence varies, but it's important to have a strategic plan. OnceHub helps you execute this plan by creating different event types for annual reviews, quarterly check-ins, or ad-hoc meetings, each with its own specific availability and duration settings.

Should I have a different booking page for my prospecting meetings vs. my client meetings?

Yes, this is a best practice. Separate pages allow you to control the experience for each audience. You can set different meeting durations, availability, and include qualifying questions on the prospect page while offering more flexible options for existing clients.

What's the best way to handle clients who need to reschedule or cancel at the last minute?

Use automated email and SMS reminders, which are highly effective for reducing no-shows. OnceHub allows for easy rescheduling and cancellation directly through a link in the reminder, so clients can manage their own appointments without needing to call you.

How can I use a scheduling tool to filter out unqualified leads and save time?

Use a routing form before the booking page. This form can ask key questions about asset size, specific goals, or location. Based on their answers, the tool can either route them to an appropriate advisor or politely decline the meeting if they don’t meet your criteria, saving valuable time.

What are the key differences between Calendly and OnceHub for a financial advisor? Which is better for compliance?

OnceHub is often preferred by financial advisors for its compliance-ready features. It offers advanced routing forms, more robust audit trails, and the ability to add specific disclaimers to booking pages, which are crucial for regulated industries.

How can I integrate my scheduling software with my existing CRM (like Redtail or Wealthbox)?

Top scheduling tools have native integrations or use platforms like Zapier to connect with your CRM. This automation can automatically create a new contact record when a prospect books a meeting or logs a note in an existing client's file after an appointment.

What are the best practices for publishing my booking link? Should I put it in my email signature, my website, or both?

Publish it everywhere that is relevant. Place it in your email signature, on your website’s contact page, in your client portal, and in your newsletter. This makes it easy for prospects and clients to book with you whenever it is convenient for them.

Are online scheduling tools secure enough to handle sensitive client information?

Yes, reputable scheduling platforms are secure. They use features like two-factor authentication, data encryption, and provide SOC 2 reports and other certifications to prove their commitment to security. For regulated industries, choosing a platform with built-in compliance features is key.

Can I use my scheduling tool to coordinate meetings with a client's spouse or multiple advisors (panel meetings)?

Yes. Most professional-grade scheduling tools have features for multi-person meetings. This allows clients to invite guests (like a spouse) or for you to coordinate a meeting with another advisor in your firm, such as a tax specialist.

What is the best way to manage my availability without having to constantly update my calendar?

Sync your scheduling tool with your primary calendar (Google, Outlook, etc.). The tool will automatically block off time when you have a pre-existing meeting, ensuring you are never double-booked and your available slots are always up-to-date.

Better scheduling starts here

No credit card required